Estate Planning Glossary: Part 2

Now you know some of the basic terminology surrounding estate planning. It’s time to learn some additional concepts, as well as some of the more complicated terms. Again, your estate planning lawyer will help you through these concepts when you meet to discuss wills and trust. However, it’s always a good idea to educate yourself ahead of this meeting so you can ask more pointed questions about the particulars of your estate.

Pour Over Will

A pour over will specifies that any assets that were not included in your living trust will become a part of it upon your death. The assets “pour over” into that trust, which gives this short will its name.

Power of Attorney

You give someone power of attorney to make decisions on your behalf and to sign your name in your absence. Power of attorney is necessary if you become seriously ill, injured, or mentally incapacitated and are not able to make decisions for yourself or to sign your own name.

Probate

Probate is the legal process of distributing your assets and paying off your debts after your will. When your estate enters probate, the court makes these decisions. That’s why it is so important to have the proper wills and trusts established so that your wishes are followed exactly and your estate is not managed according to the whims of the court.

Quitclaim Deed

A quitclaim deed allows you to transfer real estate without going through the process of selling it. Spouses sign a quitclaim deed when they divorce and transfer all their interests over to their partner. You can also sign a quitclaim deed if you want to transfer your property before your death. There may be tax advantages to doing so, depending on the value of the property and other factors.

Special Needs Trust

You can provide for a disabled loved one by setting up a special needs trust. The trust will pay out according to the directions you provide, which may include payments on a schedule or a one-time payment when certain conditions are met. Payments from this trust will not interfere with government benefits the disabled loved one may receive.

Stepped-Up Basis

When your assets pass on to your beneficiaries, they are revalued and given a new basis, known as the stepped-up basis. The reason is that your assets have likely appreciated since you acquired them, such as your home. If your beneficiaries had to pay taxes on the gains from when you acquired the asset, they may end up owing quite a lot. The stepped-up basis helps them save a lot in taxes when they sell the asset.

Tenants-in-Common

You are tenants-in-common if you have joint ownership of a property with another person. For example, if you are not married, you may decide to purchase a home with a friend. If you are married, you and your spouse may have gone in on a vacation property with another couple. You are tenants-in-common, and when you die, your ownership share goes to your heirs.

Totten Trust

A Totten Trust is a “pay-on-death” account. When you die, the account transfers to your beneficiary. These trusts may include the terms “transfer on death,” “in trust for,” “pay on death,” or “as trustee for.”

Unified Credit

The unified credit is the amount that a person can deduct from the taxes they owe on the estate. The credit is currently $1,772,800, which is how much would be due on $5,120,000 in assets. Therefore, just over $5 million in assets are exempt from estate taxes.

Uniform Transfer to Minors Act

Typically, you cannot leave assets to a minor directly because they are not legally able to sign documents or to manage that money. Through the Uniform Transfer to Minors Act (UTMA), you can leave assets to a minor by appointing a custodian. That person would manage the assets for the minor until they became of legal age or a later age that you decide. You would need to appoint a custodian if you have minor children in case you die unexpectedly.

There are many options for creating an estate plan that will get the assets you want to the beneficiaries that you want, whether you need to create a specialized trust or a simple will. Your Scottsdale estate lawyer will help you understand the options and give you advice on how best to achieve your goals.

In Arizona, Virtue Law can help you with your estate planning. We put together simple wills and trusts, create guardianships and conservatorships, create complex trusts, and more. We also litigate probate if you are the beneficiary of an estate that is held up in the courts. Call us in Arizona today to talk with an estate lawyer about your estate planning needs.

Published By:

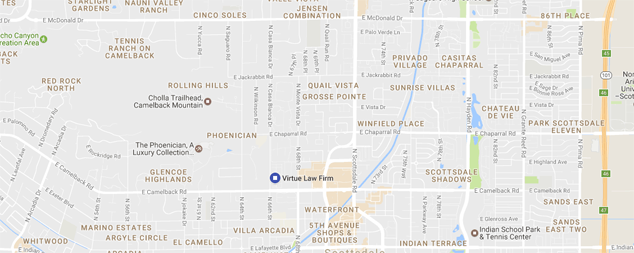

Virtue Law Firm

Scottsdale, AZ 85251

Phone: 480-941-0710

Website: arizonaestatelawyer.com

Email: [email protected]